Top Compliance Tips For Employers Under Employment Law

The Unseen Risks of Misclassification

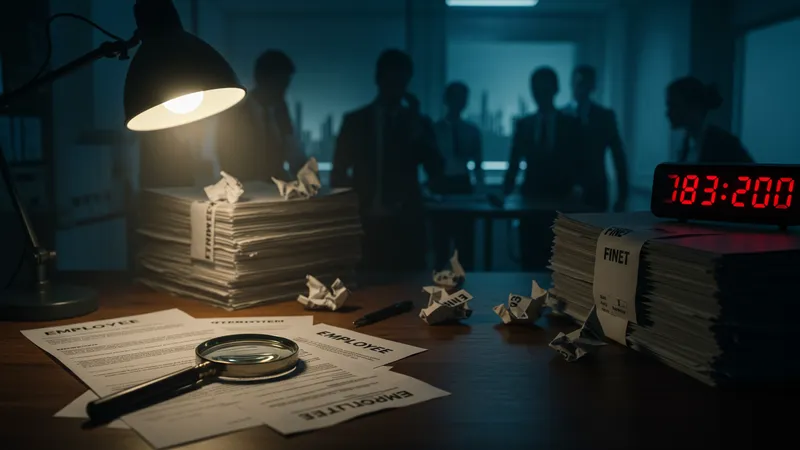

Misclassification of employees is a trap many companies fall into, whether through oversight or design. Labeling employees incorrectly as independent contractors can lead to staggering repercussions. And the real kicker? Some businesses don’t even acknowledge this as a risk until it’s too late.

Misclassification leads to a loss of workers’ rights and potential unpaid taxes. While auditors often fixate on this during inspections, it’s the businesses that suffer in the end with fines and damaged reputations. Knowing the difference between a contractor and an employee is no longer enough—the contextual legalities must be appreciated.

Using the wrong classification title can invite unannounced investigations from government bodies. Remember, these designations aren’t just about payroll—they affect benefits, protections, and even rights to organize. It’s a hidden issue surfacing unexpectedly during robust audits, causing more than fiscal distress.

The silver lining? A proper classification strategy, confirmed through regular reviews, not only ensures compliance but also fosters trust within the workforce. Yet, there’s a nuance within this process that can transform how businesses perceive employment standards altogether.