No Down Payment? No Problem: Best Car Loans For Bad Credit

The Future of Car Financing: Automation and AI

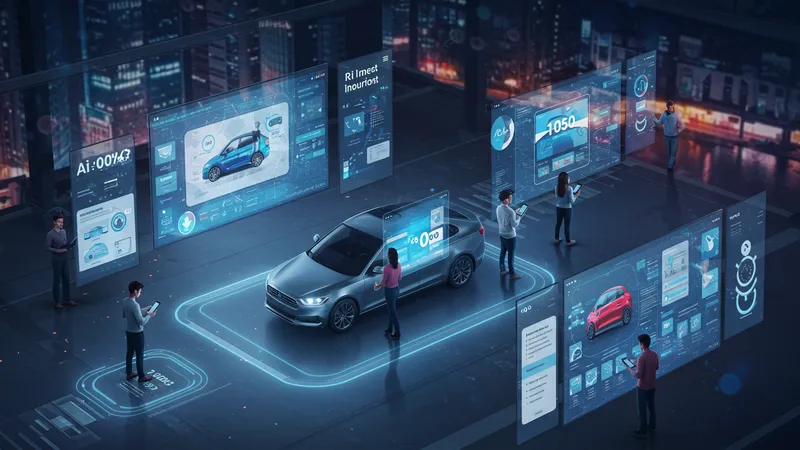

What does the future hold for car financing, and how are automation and artificial intelligence reshaping the industry? Emerging technologies are streamlining the lending experience, making no down payment loans not only viable but attractive for many with less-than-perfect credit. AI-driven processes can evaluate applicants more quickly and effectively, breaking down barriers and providing speedy, fair decisions. But there’s another dimension to consider…

Financial technologies (fintech) are ushering in revolutionary changes, from seamless loan applications to real-time approval notifications through mobile platforms. Gone are the days of waiting anxiously for a response; instead, instant feedback is empowering consumers to make informed decisions on the fly. How far does this tech-driven shift truly stretch?

The integration of AI also enables more tailored loan offers, adjusting terms based on your unique financial snapshot—not just your credit score. This personalized touch ensures the terms align with your current capabilities and future potential, creating a customized plan that fosters financial growth and stability. Still hungry for what the future holds?

Ultimately, as automation refines predictive analytics in lending, transparency and efficiency will increase, benefiting all parties involved. By creating a more equitable and efficient system, fintech innovations are making car ownership attainable, safe, and appealing to an even wider audience. What final lessons can we glean from these advances?