Liability Insurance: What It Is And Why You Need It

The Startling Truth About Liability Gaps

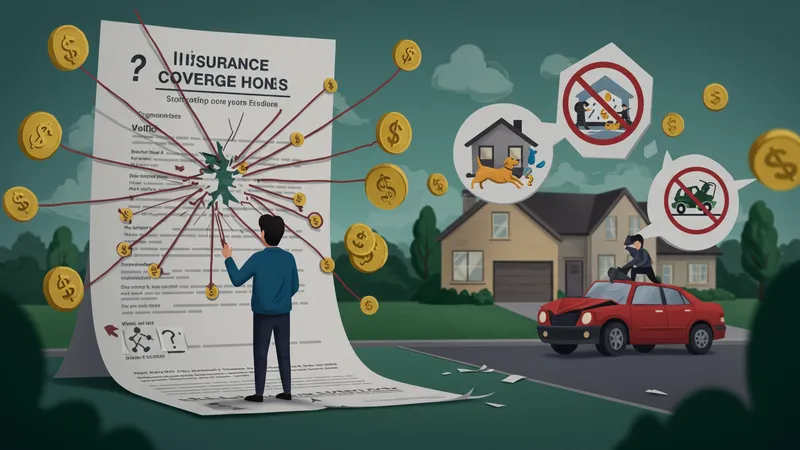

When most people consider liability insurance, they often assume a single policy covers all potential risks. However, the reality can be starkly different. Many standard home and auto insurance policies include gaps, especially when it comes to high-limit claims. For instance, while it may seem comprehensive, a homeowner’s policy may not cover certain accidents or dog bites, which could lead to unexpected out-of-pocket expenses.

Moreover, most are shocked to learn that liability limits often don’t account for inflation or the rising cost of medical bills, meaning a tragic accident could easily exceed your coverage. But don’t panic just yet; there are strategies to bridge these gaps you might not be aware of. What you’re about to read might completely alter your understanding of coverage needs.

Umbrella policies come into play here, providing excess coverage beyond standard policies. Yet, many policyholders are unaware these exist or assume they’re prohibitively expensive. The truth? Umbrella policies can start as low as $150 a year while offering millions in additional coverage. But there’s one more twist: selecting the right provider is crucial.

Some insurance companies embed fine print that can nullify parts of your umbrella coverage under specific conditions, such as engaging in certain hobbies or hosting events. This insider insight is key to ensuring you have full protection. But before you dive into purchasing an umbrella policy, there’s an undiscovered factor that could save or sink you financially…