Guide To Filing ITR For Freelancers In India

Planning Beyond Taxes: The Freelancer’s Holistic Strategy

While taxes form a crucial core of financial literacy for freelancers, broad planning encompasses retirement and investments. Tax-aversion isn’t the ultimate goal but a pathway to broader financial autonomy encompassing multiple life aspects demanding attention simultaneously.

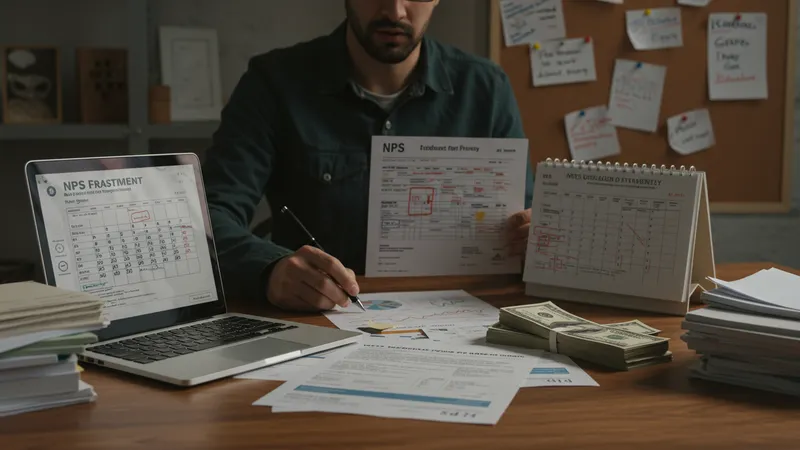

Pension accounts like NPS, though occasionally overlooked in favor of immediate gains, secure longer-term safety nets many fail to consider. This strategic oversight often proves detrimental when spanning decades of career-building engagements.

Investment linkages coordinated with tax strategies add layers leniently, introducing much-needed elasticity to fiscal paradigms. Harnessing market instruments alongside savvy taxation establishes a resilient, multifaceted portfolio necessary today.

Ultimately, this holistic view challenges freelancers to seek financial fluency continuously. It’s an enlightened mix of adventurous frontiers intertwining personal and professional development inseparably. And now, for the final revelation—a storytelling crescendo redefining conventional expectations forever…