Best Health Insurance Plans Available In Mexico

The Unseen Risks of Ignorance

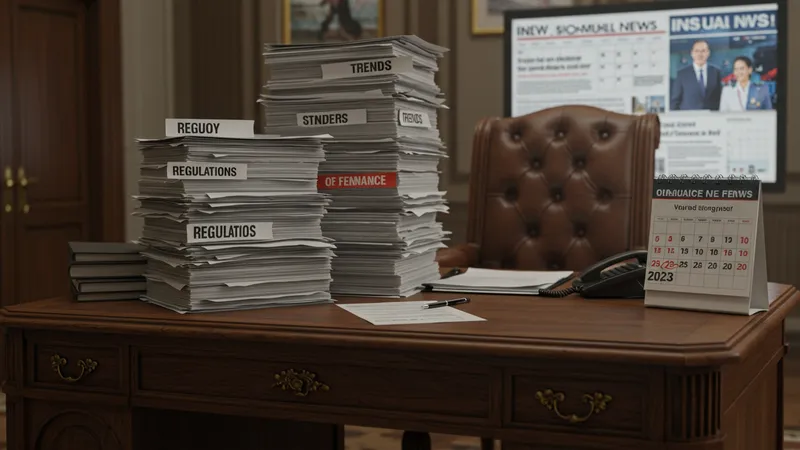

In the world of rapidly evolving insurance, ignorance isn’t bliss—it’s risky business. As more consumers demand transparency and innovation, staying ignorant of trends and feedback can jeopardize an insurer’s existence.

Regulatory oversight is tightening, and failure to adapt to new compliance standards can prove costly. Ignorance of legal requirements holds significant financial and operational risks. But there’s another side to this ignorance…

Ignorant practices can also lead to a decline in consumer trust, vital in a sector so dependent on long-term relationships. Lack of transparency and adaptability directly affects satisfaction and renewal rates.

The unseen risk is clear: without embracing the winds of change, insurers not only risk financial damage but also a diminished industry reputation. However, there’s hope in the hidden opportunities these changes present…