Best Auto Insurance Companies Ranked By Claim Payout Speed

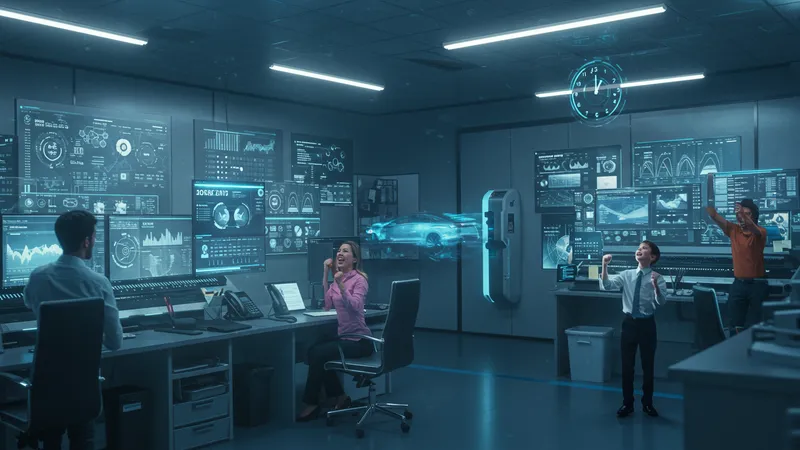

The AI Revolution in Auto Insurance

Artificial intelligence is more than just a buzzword; in the auto insurance world, it’s the secret weapon that’s changing the landscape. Insurers using AI are slashing claim processing times by sifting through data faster than any human could. The result is a sooner-than-expected settlement hitting your account, which is something drivers everywhere can celebrate.

With algorithms capable of analyzing accidents in real-time, even the investigation stage has gone on a diet down to hours instead of days or months. These machines learn from each interaction, becoming sharper, quicker, and more accurate over time. But there’s one more twist…

Insurance companies are not just stopping at claim procession efficiency; they’re actively predicting the likelihood of accidents and adjusting their risk assessments accordingly. Such proactive measures mean they can better buffer risks, ensuring faster payouts when the unfortunate does occur.

This ever-evolving technology landscape means the industry might soon see a world where claims are processed on auto-pilot, and customer interactions are reduced to lightning-fast resolutions. What you read next might change how you see this forever.