Annuities: What They Are And How They Work

Debunking Common Annuity Myths

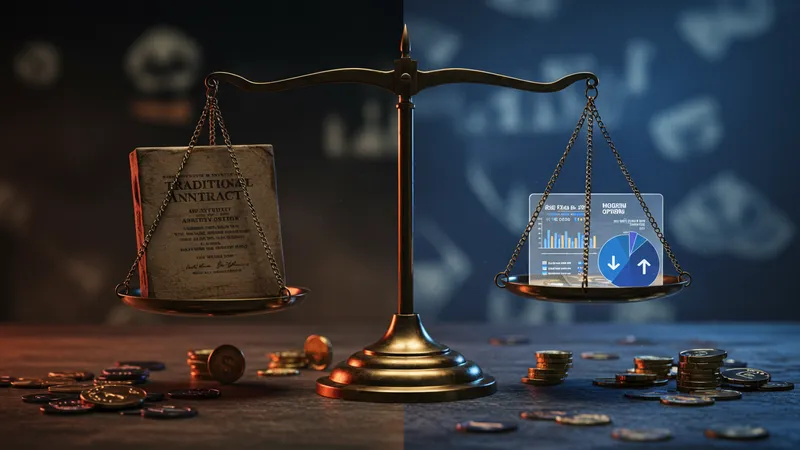

One of the most common misconceptions about annuities is that they are irrevocably bad deals. Critics argue that annuities are rife with high fees and offer lackluster returns. But is that genuinely the case? Financial analysts have identified several low-cost annuity options that break this stereotype. For instance, fee structures have evolved, providing more transparent and competitive pricing models than ever before.

Another widespread myth is that annuities are exceedingly rigid and inflexible. While it’s true that some annuities lock your money in, there are diverse types now offering flexible withdrawal options to cater to changing financial circumstances. Modern annuity products have adapted to the market’s demands for liquidity and adaptability, providing much-needed maneuverability.

The notion that “annuities are just savings disguised with fancy terms” couldn’t be more misleading. Unlike simple savings, annuities provide a structured retirement strategy that incorporates a robust risk management component. Guaranteed income streams, tailored to specific needs, ensure stability regardless of market conditions. This takes away the speculative risk inherent in relying solely on investments such as stocks or bonds.

Finally, the belief that annuities are a product solely for the aging population is out-of-date. Increasingly, younger professionals are recognizing the benefits of beginning their annuity planning early. It’s not merely about securing post-retirement income; it’s about building a comprehensive financial foundation that gives the flexibility to pursue life goals with confidence. What’s next on this journey may surprise you, as we uncover the hidden layers of complexity and adaptation that annuities offer.