An Informational Overview Of US Fintech Impact On Egypt’s Lending Industry

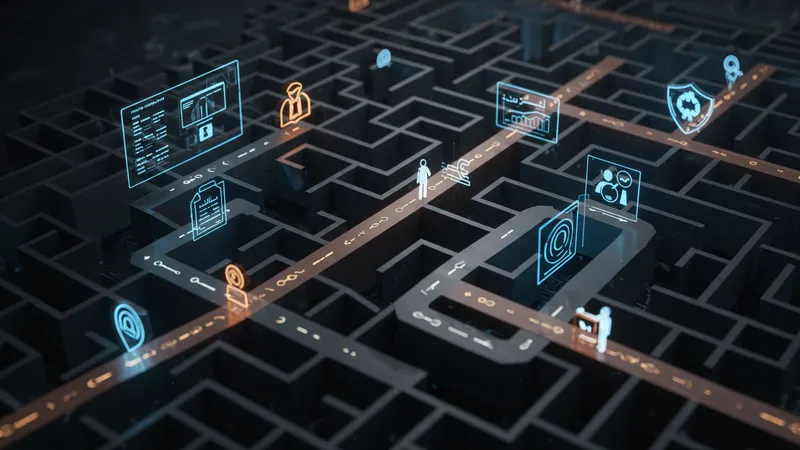

The Regulatory Maze: Finding the Right Path

As fintech accelerates its grip on Egypt, policymakers face the daunting task of managing this growth while safeguarding the economy. The regulatory landscape is a complex web, with authorities striving to protect consumers without stifling innovation. It’s a delicate balancing act that poses its own set of challenges…

Current regulations focus heavily on financial transparency and consumer protection, yet the speed of fintech evolution often outpaces bureaucratic processes. There’s an acknowledged gap that fintech companies exploit, maneuvering quickly to establish dominance. But the true test lies in adaptability – whether the legal framework can evolve as rapidly as the technology. This tug-of-war reveals layers yet unseen…

To promote fintech innovation, regulators are exploring sandbox environments where startups can test products in controlled settings. These sandboxes offer a safeguard against potential market disruptions while encouraging creative solutions. Yet, the labyrinthine process of moving from testing to market still deters potential innovators. What lies beneath this regulatory approach is more profound than expected…

The global nature of fintech also means that Egypt’s regulatory challenges are not isolated. Cross-border transactions and international partnerships call for unprecedented levels of cooperation between countries. The future of Egypt’s fintech, therefore, hinges on how well these collaborations are managed—hinting at a landscape that is as political as it is financial. What comes next will define Egypt’s role on the global fintech stage…