A Guide To Comparing Health Insurance Plans In Thailand And The USA In 2025

Decoding Deductibles and Maximums

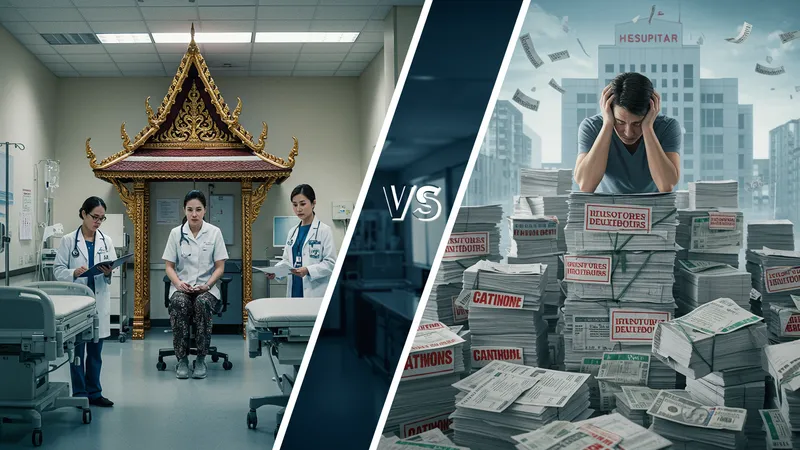

Understanding the fine print of deductibles and maximum coverage limits can make or break your health insurance choice, particularly when comparing two vastly different systems like those in Thailand and the USA. Many find Thai policies often have lower deductibles, which translates to money saved at critical times. However, an expat’s story highlighted a startling twist…

In the U.S., the high deductibles associated with certain plans often deter people from seeking necessary care. Buried within the policy documents are sometimes clauses that exponentially increase these amounts based on usage or specific conditions. It’s a detail often glossed over during initial selection, creating financial blind spots. But there’s something even more peculiar about these figures…

Conversely, Thai plans sometimes feature incredibly low out-of-pocket maximums, effectively capping costs significantly lower than most American plans. This ensures minimal financial distress for policyholders, fostering peace of mind. An aspect often surprising to new expats is the lack of complex tier systems that make U.S. plans convoluted. Curious about how this approach came to be? Here’s the lesser-known story…

The simplicity and transparency of Thai insurance have forced some American insurers to adapt, albeit slowly, by simplifying offerings and adjusting policies to better compete. It’s a fascinating shift that continues to develop as more users voice their preferences for clear, straightforward insurance solutions. Are you intrigued by where this transition leads? Stay tuned, there’s more!