A 2025 Comparison Of Mortgage Rates In Alexandria, Egypt And Atlanta, USA

How Culture Shapes Mortgage Markets

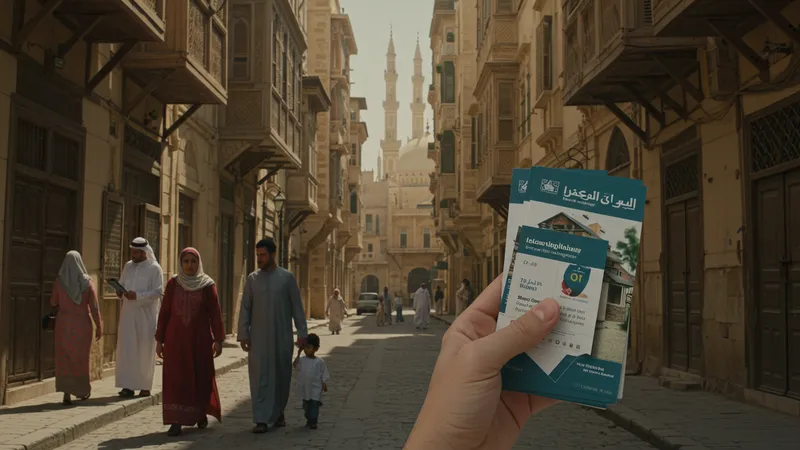

In the heart of Alexandria, culturally ingrained notions about home ownership heavily influence consumer behavior. Houses aren’t just assets; they represent familial legacy and long-term security. This cultural emphasis drives local demand, pressing banks to innovate mortgage solutions that cater to these deeply rooted values. Cultural factors aren’t just shaping the rates; they’re reshaping the real estate approach altogether.

The interplay between traditional values and modern financial strategies highlights a unique scenario. Alexandria banks are innovating by introducing Sharia-compliant mortgages, offering appealing options that align with local preferences. This sensitive market adaptation, aligning religious principles with economic demands, crafts a unique dynamic that’s captivating global attention. But is this trend sustainable long-term, or will market volatility test its boundaries?

Conversely, Atlanta’s housing market reflects an entirely different cultural tapestry. Younger, diverse populations bring varied preferences, seeing homes as gateways to community identity and personal expression rather than strictly financial assets. This shift encourages housing developments that embrace diverse lifestyles, creating vibrant, multifaceted neighborhoods.

As Atlanta’s cultural melting pot diversifies, its housing market responds to such influence by offering flexible lending options tailored to diverse demographics. By introducing comprehensive financial inclusivity practices, mortgage lenders are exploring undiscovered opportunities. This culture-centric banking evolution seeks to redefine accessibility and affordability in unexpected yet progressive ways.